ISEG presents a master's degree for people who want to make a difference in the insurance world.

Our Masters in Actuarial Science offers students the chance to gain a solid academic foundation in up-to-date actuarial knowledge, statistics and finance, providing them with the skills and background required to become successful actuaries.

We designed our master's programme, which is fully accredited by the UK's Institute and Faculty of Actuaries (IFoA) and listed by the US Society of Actuaries SoA) to cover the new IFoA syllabus, which now has a strong computational component. Our sylabus covers the core syllabi of the Actuarial Association of Europe and the International Actuarial Association, with a fee minor exceptions, related to concepts that must be covered by the professional association.

It's one of the few non-British programs fully accredited by the Institute and Faculty of Actuaries (IFoA) in the UK. The new IFoA curriculum has been adopted since the 2018/19 school year. The master's is also on the UCAP list of the Society of Actuaries (SOA) in the USA.

This program provides in-depth coverage of the most up-to-date actuarial knowledge and skills that actuaries are required to use.

ISEG's Masters in Actuarial Science is one of the 50 best masters in insurance according to the Eduniversal Best Masters ranking (currently ranked at no. 10).

ISEG has excellent modern facilities, including an extensive library, which is remarkably complete in Actuarial Science. Students have access to study rooms available during extended hours.

ISEG has a group of lecturers whose achievements in international research are on par with the best international schools of Actuarial Science. Some of them are practitioner actuaries. Our academic staff is dedicated and always willing to support and advise students.

As success in the professional world is not just about passing exams and gaining exemptions, ISEG helps students acquire other skills. Research seminars, seminars with speakers from the industry organized by the ISEG Actuarial Science Club, a career development programme, and a career development team, which provides counseling services, are also at students' disposal.

This program offers many internship opportunities, an advantage when students apply for jobs.

An ISEG team of students of the Actuarial Science Masters program is in the top 3 of the world competition Student Research Case Study Challenge 2019, promoted by the American Society of Actuaries (SOA), repeating the result of the 2018 Challenge.

The Masters in Actuarial Science requires a solid academic background in Mathematical Analysis, Probability and Statistics. This typically implies holding a bachelor's degree, either national or foreign, in Mathematics, Mathematics with Economics, Statistics or some of the bachelor's degrees in Economics, Finance or Management.

Applicants from other fields will be considered on a case-by-case basis. According to Article 17d) of Decree-Law No. 74/2006 of 24 March, other applications will also be considered, should they be deemed appropriate by the selection jury based on a curricular analysis.

Students in the final year of the 1st Cycle can apply by presenting the certificates of those Course Units already completed, subject to concluding the degree.

The admission and ranking of the candidates are explained in the Admission Regulation Document.

| Year 1 – Semester 1 | Credits |

|---|---|

| Computation Tools for Actuaries (IFoA: CS1 -10%) | 4 |

| Financial Markets and Investments (IFoA: CM2 -40%) | 6 |

| Financial Mathematics (IFoA: CM1 -45%) | 6 |

| Probability and Stochastic Processes (IFoA: CS1 -15%; CS2 -30%) | 8 |

| Risk Models (IFoA: CS1 -35%) | 6 |

| Year 1 – Semester 2 | Credits |

|---|---|

| Generalized Linear Models (IFoA: CS1 – 30%; CS2 – 10%) | 4 |

| Loss Reserving (IFoA: CM2 – 10%) | 4 |

| Risk Theory (IFoA: CS2 – 15%; CM2 – 10%) | 8 |

| Survival Models and Life Contingencies (IFoA: CM1 – 55%) | 8 |

| Time Series (IFoA: CS2 – 20%) | 6 |

| Year 2 – Semester 1 | Credits |

|---|---|

| Models in Finance (IFoA: CM2 – 40%) | 6 |

| Solvency Models | 4 |

| electives • Actuarial Data Science • Actuarial Topics (IFoA: CS2 – 25%) • Asset Liability Management • Finance and Financial Reporting (IFoA: CB1-100%) • Pension Funds • Ratemaking and Experience Rating (IFoA: CS1 – 10%) | 4 6 4 6 4 4 |

| Year 2 – Semester 2 | Credits |

|---|---|

| Master's Final Work – MFW • Dissertation • Project • Internship | 30 |

*Students must pass a total of 18 CREDITS in elective units.

See the description of each Curricular Units here.

Applications for all masters at ISEG are online.

Candidates for the Master in Actuarial Science are:

The Masters Scientific Commission will attribute a classification grade (calculated as described in the following section) to the students that meet the pre-requisites, based on their final grades of the 1st Cycle, and also on the curricular analysis, and sometimes by an interview.

Students with an attributed classification grade higher than 12.5 points will be considered for ranking, which is made according to that grade. Students with a grade higher than 14.5 points may be accepted in advance of the ranking.

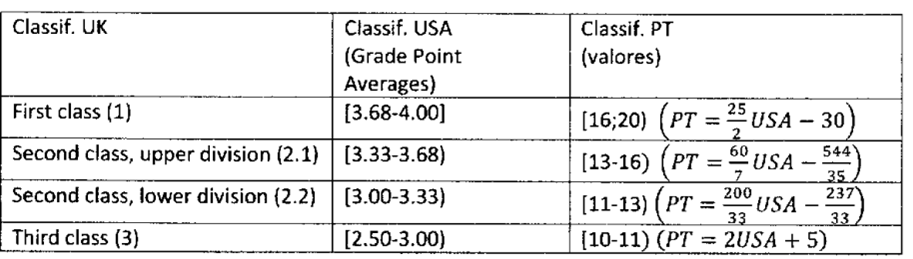

Calculation of the attributed classification grade

All candidates should have an excellent command of the English language, written and spoken.

These are provisional tuition fees for 2024/25, subject to confirmation by the University of Lisbon statutory bodies.

| Students from | First Year | second year | Total |

| Within the European Union | € 3,500 | € 2,000 | € 5,500 |

| Outside the European Union | € 4,500 | € 2,500 | € 7,000 |

Financial restrictions should never come in the way of your access to higher education, and that is why we believe in providing equal opportunities for everyone.

A specific tuition fee payment schedule may be agreed upon request by the student.

If you are not an EU, EEA, or Swiss citizen, you need a Student VISA.

Once you have decided to join the master's program and paid the 1st tuition fee to secure your place, you can issue the acceptance letter on the FENIX Portal. This document will be needed later to apply for a Student Visa. The student visa must be requested at the nearest Portuguese Embassy or Consular Office in the country of origin.